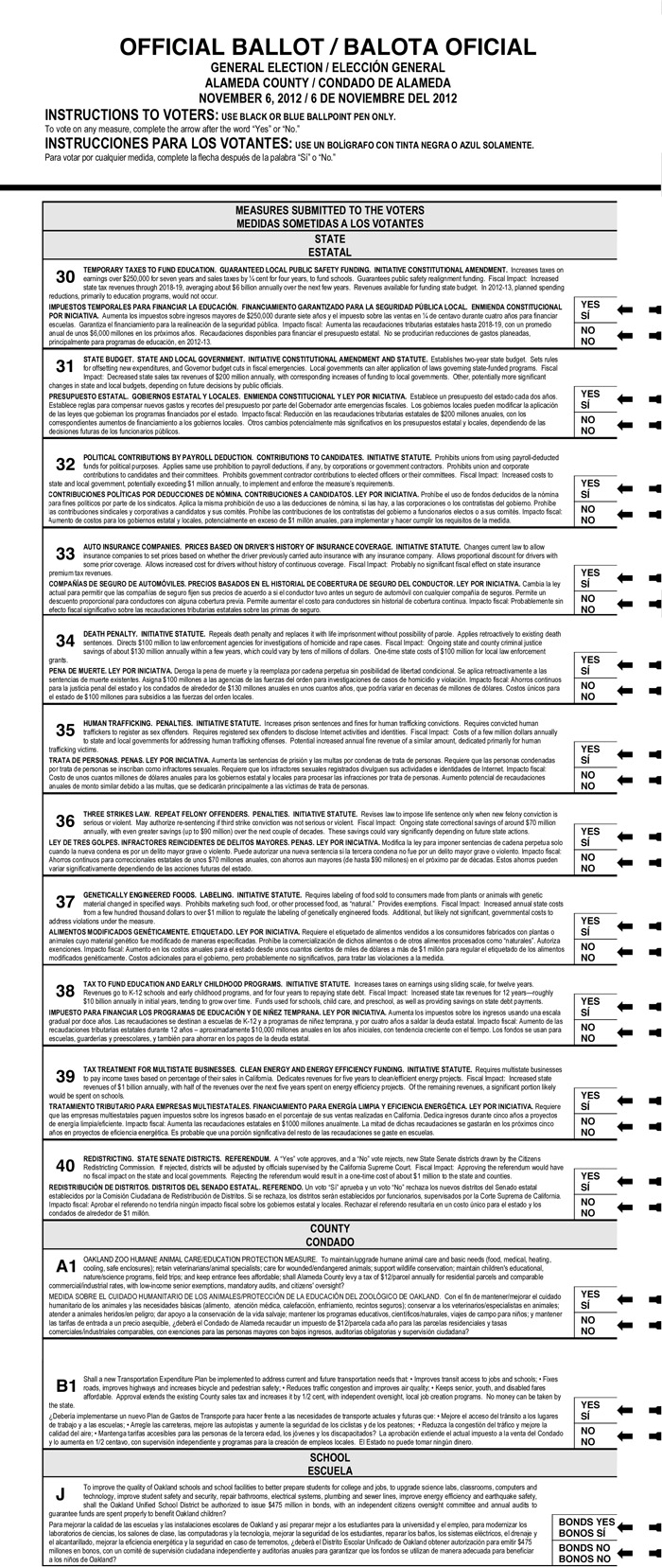

If passed, for the next seven years the Schools and Local Public Safety Protection Act of 2012 would increase income taxes on individuals with earnings over $250,000. It would also temporarily boost sales taxes by a quarter-cent for four years. The initiative aims to make back some of the $56 billion that has been cut from the state budget for education over the past four years.

PRO: Supporters say Prop. 30 would raise about $6 billion dollars per year for schools over the next four years.

For more information: http://www.yesonprop30.com/

CON: Opponents say Prop. 30 does not guarantee funds will go towards educational programs.

For more information: http://www.stopprop30.com/

If passed, the Government Performance and Accountability Act would amend the California constitution to establish a new two-year state budget (rather than a yearly cycle) and allow local authorities to change state and local budgeting and oversight procedures. Prop. 31 would allow the governor to make unilateral cuts during fiscal emergencies, require the legislature to offset new expenditures greater than $25 million, are require performances reviews of state programs.

PRO: Supporters say Prop. 31 would enable local governments to develop their own procedures for administering state programs.

For more information: http://www.accountableca.org/

Measure J is a $475 million bond measure being proposed by the Oakland Unified School District. The bonds would create immediate capital for the district to spend exclusively on the purchase, construction or improvement of school facilities as dictated by state law. The bonds would be paid back with interest using tax levies on Oakland property owners. Property owners will be taxed for six years based on the value of the property they own. The maximum tax rate is estimated at be $39 per $100,000 of assessed property value, rising to a maximum of $60 per $100,000 by 2019. The district's projected plans include improving the seismic safety of school sites, replacing portable classrooms with permanent buildings and installing photovoltaic systems.

Con: No argument against Bond Measure J was submitted for inclusion on Alameda County sample ballots. There appears to be no organized opposition.

Pro: Supporters of Measure J say additional funding will make OUSD facilities earthquake safe, and allow the district to upgrade technology and repair facilities.

If passed, the Paycheck Protection Initiative would prohibit corporations and unions from using any portion of employee payroll deductions to support political campaigns. It would prohibit contributions by contractors to government officials who control contracts awarded to them and prohibit corporate and union contributions to political candidates.

PRO: Supporters say Prop. 32 would decrease the influence of business and labor interests on politics.

For more information: http://www.yesprop32.com/

CON: Opponents say Prop. 32 would reduce the ability of labor unions to spend on campaigns and have a voice in politics. Unlike corporations and governments, unions draw most of their funding for political campaigning from automatic employee payroll deductions, so opponents argue this would have a disproportionately limiting effect on unions.

For more information: http://www.votenoon32.com/

CON: Opponents say Prop. 31 would force conflicting terms into law, and give the state unnecessary powers in its budgeting.

For more information: http://www.prop31facts.com

If passed, the 2012 Automobile Insurance Discount Act would allow insurers to raise insurance costs for drivers without a history of continuous coverage, and lower them for drivers with a history of continuous coverage. Military service members and those who lose car insurance as a result of being unemployed for up to 18 months are exempt from raised costs.

PRO: Supporters say Prop. 33 would allow safe drivers to keep discounts on car insurance as they switch providers.

For more information: http://www.yesprop33.com/

CON: Opponents say Prop. 33 would benefit auto insurers by allowing them to raise premiums by up to $1,000 on safe drivers without a history of continuous coverage.

For more information: http://www.stopprop33.org/

If passed, the Savings, Accountability, and Full Enforcement for California Act would repeal the death penalty and change the state’s maximum prison sentence to life imprisonment without the possibility of parole. California had the death penalty from 1850 until the California Supreme Court ruled it illegal in 1972. The death penalty was reinstated in 1977 by the state legislature.

PRO: Supporters say that repealing the death penalty in California would save taxpayers $1 billion over five years through reduced legal fees for the state. Supporters say that the death penalty is morally wrong.

For more information: http://www.yeson34.org/

CON: Opponents say that the death penalty is an appropriate punishment for those who are convicted the most serious crimes.

For more information: http://www.waitingforjustice.net/

If passed, the Californians Against Sexual Exploitation Act, or CASE Act, would fine and increase prison sentences for people convicted of human trafficking. Human trafficking is the illegal trade in human beings, often to exploit them sexually. Maximum prison sentences would be 15 years to life, and maximum fines would be $1.5 million. It would require people found guilty of human trafficking to register as sex offenders, and to give law enforcement agencies a list of their email addresses, user names and Internet service providers.

PRO: Supporters of Prop. 35 say human trafficking is morally wrong and penalties for the crime should be increased.

For more information: http://www.voteyeson35.com/

CON: Opponents of Prop. 35 say human trafficking is wrong, but not all sex workers have been trafficked. Under a “pimping” provision in Prop. 35, anyone to whom a sex worker gives money would be labeled a human trafficker. That means the adult children of sex workers, a sex worker’s roommates, or a friend that they might take out for dinner could theoretically be convicted of human trafficking and would then have to register as a sex offenders.

For more information: http://esplerp.org/

Currently, California’s Three Strikes Law imposes a 25-year to life sentence for a third felony conviction, regardless of the third felony’s severity. If passed, the Three Strikes Reform Act of 2012 would change the law to give third strike offenders a life sentence only when their most recent offense is serious or violent, such as murder, rape, or child molestation. The initiative would take into account the nature of the third felony (assuming previous charges were not for murder, rape or child molestation), allowing current prisoners to serve reduced sentences. California’s Legislative Analyst’s Office estimates the initiative would save the state $70 million annually in reduced prison and parole expenses.

PRO: Supporters say Prop. 36 would save the state over $100 million annually in criminal justice expenses and ensure that only rapists, murderers, and other dangerous criminals stay in prison for life.

For more information: http://www.fixthreestrikes.org/

CON: Opponents say Prop. 36 would facilitate the release from prison of dangerous criminals who were sentenced to life terms because of their long criminal histories.

For more information: http://www.savethreestrikes.com/

If passed, the California Right to Know Genetically Engineered Food Act would require the labeling of food made from genetically altered plants or animals. The labels would identify the food as "genetically engineered," "partially produced with genetic engineering," or "may be partially produced with genetic engineering.” It would also prohibit genetically changed food from being labeled as “natural.”

PRO: Supporters say Prop. 37 would allow consumers to know which foods are grown using genetic engineering.

For more information: http://www.carighttoknow.org/

CON: Opponents say Prop. 37 would create new government bureaucracy charged with evaluating different foods and labeling those with genetically modified ingredients, costing taxpayers millions. They also say the process could result in numerous lawsuits over disputed labels.

For more information: http://www.noprop37.com/

If passed, the Local Schools and Early Education Investment and Bond Debt Reduction Act would increase state income taxes for the next 12 years on anyone earning over $7,316 per year. Higher-income individuals would be taxed at a higher rate, up to a 2.2 percent increase. The funds would be used to support K-12 schools and early childhood education. The initiative would raise around $10 billion per year.

PRO: Supporters say Prop. 38 would restore funds that were previously cut from public education.

For more information: http://www.prop38forlocalschools.org/

CON: Many opponents of Prop. 38 argue that Prop. 30 is a more effective means of raising funding for California’s public schools. Others say that Prop. 38 would not fund public higher education.

For more information: http://www.stopthemiddleclasstaxhike.com/

If passed, the California Clean Energy Jobs Act would increase state revenues by $1 billion annually by taxing multistate businesses based on how much business they do in California. (Multistate businesses are those that operate in California but are not based in the state.) The tax would affect only out-of-state businesses. Half of the revenue raised over the next five years will be spent on clean energy projects, including energy-efficient retrofits to schools and public buildings.

Pro: Supporters say Prop. 39 would create about 40,000 jobs in California’s clean energy and construction sectors.

For more information: http://www.cleanenergyjobsact.com/

Con: Opponents say increasing taxes on multistate businesses would create an additional $1 billion of taxes on businesses that provide jobs in California, and would cost some Californians their jobs.

For more information: http://www.stop39.com/

If passed, the Referendum on the State Senate Redistricting Plan would approve State Senate districts drawn by the Citizens Redistricting Commission earlier this year, which are already in place and have been approved by the California Supreme Court. If voted down, the districts would be redrawn and the process would be supervised by the California Supreme Court. The way in which districts are drawn determines the voter makeup of each district, which can in turn influence which candidates are elected to the State Senate.

Pro: Would uphold State Senate maps redrawn by a voter-approved commission. The commission is independent, and took over the work of redrawing districts from politicians, who previously had done the work of redistricting.

For more information: http://www.holdpoliticiansaccountable.org/

Con: In the state’s official voters guide, opponents say they “are no longer asking for a NO vote” since the new districts have already gone into effect.

If passed, the Oakland Zoo Humane Animal Care/Education Protection Measure would increase property taxes in Alameda County by $12 per residential parcel and $72 per nonresidential parcel to fund the Oakland Zoo. This tax would last for 25 years, and fund food for the animals, conservation efforts, seismic upgrades and educational programming for visiting children. These funds could used for zoo expansion, but no large projects are laid out in the text of the measure.

Pro: Supporters say Measure A1 would increase funding for a popular Alameda County tourist destination, which has seen a decline in financial support from the City of Oakland. Animals would receive high levels of veterinary care, and more children would be able to visit the zoo on field trips.

For more information: http://itsyourzoo.org

Con: Opponents of Measure A1 are primarily concerned about its effect on nearby Knowland Park, which is a possible site of the zoo’s expansion. They say the park is a ecologically rich area and expanding the zoo onto it would cause environmental damage.

For more information: http://www.saveknowland.org/2012/09/22/vote-no-on-alameda-county-measure-a1/

If passed, Measure B1 would double the portion of Alameda County’s sales tax which goes to transportation, to one cent per dollar per transaction, providing a projected $7.7 billion over the next 30 years. Revenue would be spent on highways, local roads, public transit, and bicycle and pedestrian programs. Measure B1 requires a two-thirds majority to pass.

Pro: Transit agencies and advocates say Measure B1 would help repair roads in disrepair, and pay for forward-thinking transit options in Alameda County, such as Bus Rapid Transit and bicycle programs.

For more information: http://yesonb1.com/

Con: Opponents of Measure B1 say the sales tax is regressive, meaning lower-income residents would pay a higher proportion of their income. Critics contend that additional taxes could discourage small business.

For more information: http://www.votenomeasureb1.com/